Saturday 30 June 2012

Tata Docomo slashes Photon Plus tariff plans up to 60%

After the recent cuts on 3G plans by various telcos, Tata Docomo has now

announced new

offers for its Tata Photon Plus Postpay and Prepay customers across India.

The company plans on offering high internet speeds at affordable prices and will

be reducing its tariff plans up to 60 percent. Its offers include unlimited

Internet surfing plans, usage-based plans and more. Tata Dococmo Photon Plus

postpay customers can choose from two plans - unlimited 6GB usage for only Rs.

950 rental or unlimited 11 GB for only Rs.1200. Both these unlimited plans also

offer cash back of Rs.100 per month for 12 months from date of purchase.

Friday 29 June 2012

DoT may penalise 5 telcos for under-reporting revenues

Department of Telecom is learnt to be in process of sending demand notice to five private operators for under reporting their revenues in two years.

The department has earlier issued show cause notice to Bharti Airtel , Vodafone, Reliance Communications , Tata Teleservices and Idea Cellular after a special audit revealed under reporting of revenue during assessment years starting from 2006 to 2008.

The department has earlier issued show cause notice to Bharti Airtel , Vodafone, Reliance Communications , Tata Teleservices and Idea Cellular after a special audit revealed under reporting of revenue during assessment years starting from 2006 to 2008.

Internet costlier from next month

Internet usage charge is set to increase from next month. The Department of Telecom has decided to levy a 4 per cent licence fee on Internet service providers (ISPs) from July 1, which will be doubled to 8 per cent in April 2013.

A draft of the amendment to licence fee says “a uniform licence fee of 8 per cent of the adjusted gross revenue shall be adopted for all ISP and ISP-Internet Telephony (IT) licences, in two steps starting from July 1, 2012”.

A draft of the amendment to licence fee says “a uniform licence fee of 8 per cent of the adjusted gross revenue shall be adopted for all ISP and ISP-Internet Telephony (IT) licences, in two steps starting from July 1, 2012”.

Android grew by 500% in India in one year

NEW DELHI: At its I/O event for developers in San Francisco,

Google revealed that Android grew by 500%

in India in the last one year.

"Android is a truly global phenomenon. We now have 400 million Android devices. In countries like Brazil, India and Thailand we have seen it grow by 500% in the last one year," said Hugo Barra, director of product management, Android.

Barra added that the company was not slowing down. "We are not slowing down. One million new android devices are activated every day," he said.

"Android is a truly global phenomenon. We now have 400 million Android devices. In countries like Brazil, India and Thailand we have seen it grow by 500% in the last one year," said Hugo Barra, director of product management, Android.

Barra added that the company was not slowing down. "We are not slowing down. One million new android devices are activated every day," he said.

Customer Care Executive at Aircel Ltd

Company: Aircel

Location: Chennai, TN

Date Posted: June 19, 2012

Hi! Greetings from Aircel, We are looking for " Officer - Retail Services" for our ICONIC Retail Outlet/Showrooms in Annanagar. Job Description: • Involves frontend customer interaction. • Ensure delightful services by providing First time resolution. • Preparing basic MIS for the store. • Co-ordination with different departments for customer complaints. • Spotting key opportunity areas to ensure delight for the customers. • Ensure maximum retention. • Irate customer handling. • Adhere to productivity norms. Interested Candidates, Kindly forward your resumes to the following id:

RCom to hire 6000 professionals

| BS Reporter / Mumbai/ Rajkot Jun 29, 2012, 00:50 IST |

Anil Dhirubhai Ambani Group (ADAG) firm, Reliance Communications Ltd (RCom) is planning to hire 6,000 sales and marketing persons across India. As a part of it, the company is planning to start a training program called 'School of Employment (SOE)' with National Institute of Sales (NIS).

Anil Dhirubhai Ambani Group (ADAG) firm, Reliance Communications Ltd (RCom) is planning to hire 6,000 sales and marketing persons across India. As a part of it, the company is planning to start a training program called 'School of Employment (SOE)' with National Institute of Sales (NIS).Rajan Dutta, president, corporate HR, RCom, said, "We will hire 6,000 people for sales, marketing and technology from across India during this year. We plan to ramp our business operations. The SOE program will help us to fine out skill potential candidates."

Thursday 28 June 2012

MTS Launches Aggressive Voice and Data Offerings For Customers In TN

MTS India today announced competitive and affordable plans in denominations ranging from Rs. 96 to Rs. 1499, all aimed to provide greater benefits to customers for its customers in TN.

This special voice offer gives the MTS customer the benefit of making STD calls at 25 paisa per minute with a validity of 30 days.

Google officially announces Nexus 7, on Pre-Order in UK, USA, Canada and Australia

As expected, Google has finally raised curtains overs its much talked about tablet, the Nexus 7. As the name suggests, Google Nexus 7 is 7 Inch tab made by Asus for Google priced at $199 in the USA and shipping mid-July. Nexus 7 was announced at the Google I/O Keynote and is already on Pre-Order in U.S., U.K., Canada and Australia. Nexus 7 is world’s first Quad Core tablet and also loaded wth Android latest iteration, the Jelly Bean. Nexus 7 is fully integrated with Google Play and lets ou Music, Video, Music, Games and Magazines as well.

Vacancy in Reliance : DISTRIBUTION SALES EXECUTIVE - KOLKATA

Description

- Achieve targeted subscriber numbers in assigned geography

- Achieve Primary targets for Handsets & RCVs

- Ensure Secondary placement & target achievement for Handsets & RCVs through Distributor Sales Representatives

- Continuously provide On-Job-Training to DSR team

- Also personally evaluate & seek to improve distribution of Open Market Handsets in coordination with distributors of other vendors (Nokia/Motorola etc.)

- Constantly focus on & increase distribution width & depth for Handsets & RCVs

- Achieve Primary targets for Handsets & RCVs

- Ensure Secondary placement & target achievement for Handsets & RCVs through Distributor Sales Representatives

- Continuously provide On-Job-Training to DSR team

- Also personally evaluate & seek to improve distribution of Open Market Handsets in coordination with distributors of other vendors (Nokia/Motorola etc.)

- Constantly focus on & increase distribution width & depth for Handsets & RCVs

Telecom licence violation: CBI to probe Tata Group

The Central Bureau of Investigations (CBI) has started probing whether the Tata

group violated telecom licence conditions by holding more than 10% equity in

more than one company in a service area. The Department of Telecommunications

(DoT) has already sent the relevant files to the agency.

Earlier, Kumar Mangalam Birla-led Aditya Birla Nuvo Ltd had written letters to various government departments and agencies alleging that the Tata group violated the licence condition in the 2005-06 period.

Earlier, Kumar Mangalam Birla-led Aditya Birla Nuvo Ltd had written letters to various government departments and agencies alleging that the Tata group violated the licence condition in the 2005-06 period.

MTS plans to launch app for mobile payment through cards

MTS to conduct pilot with e-commerce firms flipkart.com, yebhi.com on MTS MTag 3.1 Smartphones

Sistema Shyam Teleservices, which offer telecom services under the MTS brand, plans to power its smartphones with a card swipe device which would facilitate mobile payment through credit or debit cards.

"MTS is conducting pilot with e-commerce firms Flipkart.Com and Yebhi.Com on MTS MTag 3.1 Smartphones. The pilot is for two weeks after which it will launched for commercial sales," an company official said.

Bharti Airtel, Idea plan to shift data traffic to wi-fi

NEW DELHI: Indian mobile phone companies such as Bharti Airtel, Idea Cellular

and others are looking to shift a part of their data services to wi-fi hotspots, freeing up scarce 2G and 3G airwaves for

mobile telephony.

Mobile phone companies are building wi-fi hotspots to accommodate growing mobile broadband data usage among consumers. "Spectrum is limited and all over the world carriers have offloaded data on to wi-fi, integrating it with existing networks while the back haul can be any medium - copper, fibre or LTE. It's pretty much part of the plan for us as well," said Bharti Airtel's president for consumer business K Srinivas.

Mobile phone companies are building wi-fi hotspots to accommodate growing mobile broadband data usage among consumers. "Spectrum is limited and all over the world carriers have offloaded data on to wi-fi, integrating it with existing networks while the back haul can be any medium - copper, fibre or LTE. It's pretty much part of the plan for us as well," said Bharti Airtel's president for consumer business K Srinivas.

Aircel, Olive to launch three Android ICS smartphones in August

The three Android ICS smartphones will be priced between Rs 4,000 to Rs 12,000.

Olive Telecom, an India-based convergence device developer, in association with Aircel, will launch three smartphones running on Android Ice Cream sandwich (ICS) in the first week of August.

Avijit Dutt, president, marketing, Olive Telecom, said to The Mobile Indian, "Olive Telecom will launch three ICS based smartphones, in association with a leading service provider, for Indian consumers by July end or August first week, in the price bracket of Rs 4,000 to Rs 12,000."

Avijit Dutt, president, marketing, Olive Telecom, said to The Mobile Indian, "Olive Telecom will launch three ICS based smartphones, in association with a leading service provider, for Indian consumers by July end or August first week, in the price bracket of Rs 4,000 to Rs 12,000."

Android Jelly Bean statue installed at Googleplex, coming today with Nexus 7 tablet..??

Following its tradition, Google has finally spilled the Jelly Beans at its Head Quarters lawn in Mountain View, USA. We all know that Googleplex lawn has statue of the all the previous versions of its mobile os and being the latest version, Jelly Bean too has got entry in to it. We are expecting the formal announced about this latest Android Version later today at Google I/O 2012.

Wednesday 27 June 2012

New Price of BSNL Penta Tablet TPAD IS701R is Rs 3999

BSNL and Pantel Technologies have revised the price of one of their low cost tablet TPAD IS701R from Rs 3499 to Rs 3999 with BSNL connection and Rs 3250 to Rs 3749 without BSNL data plan.

Aircel FRC56 – All Local Call 1p/2sec for 180 days

Aircel FRC56- Now call 1p/2sec from Aircel.

Once again Aircel comes with the blast as new FRC (First Recharge Voucher) of Rs. 56 for the prepaid customer of west Bengal that is one of the cheapest local off-net and on-net calling with a long term validity.

The cost of voucher is only Rs. 56 that will give 180 days long validity. By this FRC the local on-net call rate goes to 1p/3sec and local off-net 1p/2sec.

Not only this, The pack content 100 MB 2g data for initial 15 days. And than SMS 50 Local/nation well be provided free of cost for 30 days.

Aircel FRC 56 Plan details.

Vacancy in Reliance Communications : Senior Manager Finance - MIS

Job Description

|

MTS Launches mPOS – Mobile as Point Of Sale

MTS India is all set to launch a revolutionary service called mPOS – Mobile as Point of Sale. mPOS user have to put the mPOS attachment (portable card reader) on an MTS Smartphone or tablet through the 3.5 mm audio jack, swipe the credit/debit card, enter transaction amount and that is it.

The total bundle (MTS MTag 3.1, mPOS attachment & One year Data plan) would be priced between Rs. 3000 – 4000. The average monthly spends on usage of MTS mPOS would be between Rs. 200 – Rs. 300.

Telecom department may offer higher compensation to prompt ITS officers to stay back in BSNL, MTNL

KOLKATA: The telecoms department is likely to unveil a higher compensation

package by June 30 to help state-owned BSNL and MTNL

coax their senior managements, involving some 1000 senior ITS officers to stay

back.

Last month, BSNL and MTNL had sought a review of an April 17 Delhi High Court order that required them to release these ITS officers by May 14 as they had all opted to return to government service where pension is higher. Both telcos had claimed such a move would derail them and had sought two years from the high court to defer the ITS repatriation exercise. But the court has given them till September 30.

Since there are no vacancies in the telecom department either to absorb so many executives, the government is working closely with BSNL,

Last month, BSNL and MTNL had sought a review of an April 17 Delhi High Court order that required them to release these ITS officers by May 14 as they had all opted to return to government service where pension is higher. Both telcos had claimed such a move would derail them and had sought two years from the high court to defer the ITS repatriation exercise. But the court has given them till September 30.

Since there are no vacancies in the telecom department either to absorb so many executives, the government is working closely with BSNL,

Former Alcatel Lucent chief Ravi Sharma resigns as Adani Power CEO, may join IT/Telecom sector

| 27 Jun 2012 | |

Ravi

Sharma, CEO of Gujarat based Adani Power, has resigned from the company. Former

South Asia chief of Alcatel-Lucent will leave the company after two years of

working at the helm. June 30th will be his last day in the

office.

Speculations

are rife that he may join IT/Telecom sector.

Sharma

was responsible for the success of Alcatel in India. Before his joining the

company as its chief, Alcatel was considered to be a small company. Later

Alcatel and Lucent merged and he became South Asia head of the combined

entity.

Ravi

Sharma also had a short stint at Videocon owned Datacom and his joining had

provided a

|

Tuesday 26 June 2012

MTS India slashes broadband tariff by up to 60 percent in Delhi

MTS India slashes broadband tariff by up to 60 percent in Delhi

2012-06-26 13:43:06, India

MTS India

Telecom Lead India: Sistema Shyam TeleServices (MTS India) has slashed MTZ Blaze tariff by up to 60 percent in Delhi NCR circle.

MTS India has more than 16 million wireless customers.

MBlaze customers in Delhi NCR Circle can avail the benefits of new tariffs through a strong retail network of 15000 retails and 125 MTS branded retail outlets.

2012-06-26 13:43:06, India

MTS India

Telecom Lead India: Sistema Shyam TeleServices (MTS India) has slashed MTZ Blaze tariff by up to 60 percent in Delhi NCR circle.

MTS India has more than 16 million wireless customers.

MBlaze customers in Delhi NCR Circle can avail the benefits of new tariffs through a strong retail network of 15000 retails and 125 MTS branded retail outlets.

Aircel to Trial Next-Gen Hotspots

Aircel Ltd. is one of more than 30 network operators globally that will trial next generation Wi-Fi hotspot technology before the end of 2012, with a view to commercial deployments in early 2013, according to an announcement by the Wireless Broadband Alliance .

The carrier-grade Wi-Fi access technology being trialed will have been approved under the Wi-Fi Alliance 's Passport program, which certifies devices and access points that enable automatic discovery and connectivity.

Ministries oppose new auction price for incumbent operators

New Delhi: In what may be good news for dual technology operators like Tata Teleservices and Reliance Communications, various ministries like law, finance, planning and corporate affairs have not supported the telecom ministry's view of charging the incumbent telecom operators the price that will be discovered in the upcoming auctions of 2G spectrum.

According to sources, these government departments felt that asking incumbent telcos to match the auction price for the 2G spectrum they hold may be legally untenable.

According to sources, these government departments felt that asking incumbent telcos to match the auction price for the 2G spectrum they hold may be legally untenable.

DoT may seek Supreme Court extension on spectrum auction

NEW DELHI: The telecom department may seek an extension of the Supreme Court mandated August 31 deadline to

conduct the airwaves auctions as the panel of ministers overseeing the sale

process will have to be reconstituted under a new chairman, an official aware of

the development told ET.

This comes as finance minister Pranab Mukherjee who heads the Empowered Group of Ministers (EGoM) that will finalise the modalities of the auctions is slated to resign on Tuesday and file his nomination for the Presidential poll.

This comes as finance minister Pranab Mukherjee who heads the Empowered Group of Ministers (EGoM) that will finalise the modalities of the auctions is slated to resign on Tuesday and file his nomination for the Presidential poll.

Sony puts spotlight on its first 4G smartphone Xperia Ion

Instead the company is using the US introduction of its Xperia Ion to highlight the entertainment experiences a person can have using the device, like playing video games and watching movies.

Since Sony is also an entertainment company, the Xperia Ion ad campaign is an opportunity to highlight Sony-owned content like the comingSpider-Man movie, music by the duo Matt and Kim, and PlayStation video games. The device, a 4G LTE Android phone, will be available through AT&T and will cost $99.99.

Cameras with 1,000 megapixels..Releasing soon

It is not the world's first gigapixel camera, but it is the smallest and fastest and opens up prospects for improving airport security, military surveillance and even online sports coverage, its developers say.

A pixel is a small light point in a digital image, concentrations of which together form a picture.

Tata Docomo Launches New Service Plan for BlackBerry Curve 9320 and BlackBerry Curve 9220

Tata Docomo, today launched an exclusive postpay plan on new BlackBerry Curve 9320 and BlackBerry Curve 9220 smartphones for GSM customers in India.

As part of the new Rs. 599 monthly service plan, Tata Docomo GSM customers will now get 600 minutes of free local and national calling, 600 free local and national SMS messages and unlimited BlackBerry Internet Service with the purchase of the BlackBerry Curve 9320 or BlackBerry Curve 9220 smartphone.

Vodafone India Launches Special International Roaming Pack – Rs. 1499

Vodafone India, one of India’s leading telecommunications service providers, today launched an attractive international roaming pack for its customers in India that will make international roaming worry-free and affordable.

As per the new offer, Vodafone subscribers can now avail international roaming services at 60% discount rate for Voice, Data and SMS in one single pack. This discount offer is applicable across 40 countries on specific partner networks across the globe.

MTS to introduce new smartphone, tablet range soon

MTS is planning to launch a range of smartphones and a tablet in the next two weeks.

CDMA services have always suffered because of lack of handset options. MTS, which provides only CDMA services in the country, wants to undo this shortage by introducing a range of smartphones and one tablet in the next two weeks.

"We are going to launch a range of smartphones and one tablet in the next two weeks. These phones and tablets will be from different handset vendors and will offer wider choice to the customers," an MTS spokesperson informed.

"We are going to launch a range of smartphones and one tablet in the next two weeks. These phones and tablets will be from different handset vendors and will offer wider choice to the customers," an MTS spokesperson informed.

6 Smart And Impressive CSR Campaigns On Social Media

Social media thrives upon open, transparent conversations based on trust. And coupled with its viral nature, it is often elected above other mediums to drive a message home. Brands are increasingly adopting the social media route, especially when it comes to executing corporate social responsibility. This year, we witnessed some innovative CSR campaigns that show promise as well as are an indicator of the evolution of social media. The social value of ‘like/share’ and the power of the social network have been put to clever use. Here, we have brought you a collection of 5 impressive CSR campaigns that have leveraged the power of social media:

1. ‘Give Them Wings’ Expedia Facebook Campaign

This January, Expedia, the world’s largest online travel company had made a resolution to fly 100 street and working kids from the Butterflies NGO on a fun-filled 3 days holiday to Mumbai. The project, aptly called ‘Give them wings’ was run on Facebook where for every ‘like’, Expedia would contribute Rs. 10 to their travel fund. And for every ten shares amongst your friends, Expedia would contribute Rs.10 to the travel fund. In addition, out of every booking made between Dec 25, 2011 and Jan 25, 2012, Expedia had contributed Rs.100 to the travel fund. This is a clever move to increase fan count as well as bring a sense of pride amongst fans for being a part of your community. You can read more about this campaign here.

The Bloodline Club, A Tata Docomo Initiative

Needing blood urgently is a very common phenomenon and despite having a large number of donors around us, sometimes we do not connect at the right time and a life is lost. In order to tackle this issue, Tata Docomo has started The Bloodline Club, an online social initiative that leverages the power of social networks.

How The Bloodline Club works?

Once you become a member, you can request for blood in an emergency by contacting Tata Docomo on Facebook, Twitter or SMS. Just mention the blood group required and your location and The Bloodline Club will send your appeal across the network. Upon receiving your appeal, other members who wish to donate may call you directly or as per your preferred mode of contact. As a member, you too will receive requests for blood and may choose to save a life.

MTS Launches Special Tariff Plans for MTag 7.0 Android Tablet

MTS India the CDMA Mobile and Data service provider today launched a range of competitive and value for money Postpaid and Prepaid Tablet plans for its MTS MTag 7.0 Android Tablet customers.

MTS introduces one Prepaid and four Postpaid specially tailored plans for the MTS MTag 7.0 Android Tablet users. The prepaid plan comes for Rs. 598 (both FRC for new customers and STV for existing customers validity 30 days) offers 2.5 GB Free Data usage with 3.1 Mbps Speed, Free 6060 (Local + National) Seconds for Voice Calling and Free 101 SMS (Local + National).

MTS MTag 7.0 Android Tablet Postpaid Plans comes at Monthly Rental of Rs. 598 and Rs. 798 offering 2.5 GB and 5.5 GB Free Data usage with 3.1 Mbps Speed respectively plus Free 6060 (Local + National) Seconds for Voice Calling and Free 101 SMS (Local + National).

Job vacancy @ Reliance : Cluster Distribution Lead , Malda

Company: Http://reliance Communications

Location: Kolkata, WB

Date Posted: June 22, 2012

Responsible for expansion & profitability of RIM Prepaid business in the Cluster o Achieve Primary targets for Handsets & RCVs through close supervision of Prepaid Sales Executives o Set targets &

Reliance Communications launches Master Plan for GSM subscribers in Karnataka

Vodafone, Idea eating into Bharti Airtel's revenue market share

NEW DELHI: Vodafone and Idea

Cellular are chipping away Bharti Airtel's dominance in the mobile space and

have improved their revenue market shares in FY12 at the expense of the

country's top two mobile operators by subscribers, according to data released by

sector regulator Trai.

An analysis of Trai's recent report on mobile operators' revenues shows that Bharti Airtel, Reliance Communications (RCOM) and BSNL have recorded a 1.1%, 1.5% and 1.6% drop, respectively, in their revenue market share in FY12. These companies have recorded a decline of over 100 basis points on this front for the second consecutive year.

One basis point is 0.01%.

An analysis of Trai's recent report on mobile operators' revenues shows that Bharti Airtel, Reliance Communications (RCOM) and BSNL have recorded a 1.1%, 1.5% and 1.6% drop, respectively, in their revenue market share in FY12. These companies have recorded a decline of over 100 basis points on this front for the second consecutive year.

One basis point is 0.01%.

Monday 25 June 2012

Huawei to invest $2 billion in India; set up global R&D centre

SHANGHAI: Despite uncertainties in the telecom sector, Chinese equipment maker

Huawei will invest $ 2 billion over the next four years in India as it looks to

aggressively market consumer devices and set up global R&D centre in the

country.

The company, which clocked $ 1.5 billion in revenues from India in 2011-12, is also betting big on the roll out of 4G LTE services in India and is targeting more than 50 per cent share of the contracts coming in.

"2011 was a good year for Huawei because our revenue in India increased about 20 per cent... Last year, we began building a new R&D centre in Bangalore, which will house more than 5,000 people. From 2011, the plan is to invest $ two billion in five years in india," Huawei India Chief Executive Officer Cai Liqun said.

This includes the R&D centre, manufacturing and marketing among others, he added.

The company began work on setting up a research and development centre in Bangalore last year, which is expected to house more than 5,000 professionals. It is investing $ 150 million in the facility, which is expected to become operational from June 2013.

Besides, it also has a global service resource centre (GSRC) in Bangalore along with a global network operations centre (GNOC), which is its largest such centre outside of China. These centres cater to its clients across 140 countries.

"We are also planning to set up a global technology centre (GTEC) along with the others (existing centres) in Bangalore maybe this year or the next (year). This Centre will focus on providing technical support to clients globally," Liqun said.

He added that GTEC will handle technical issues of customers globally but declined to comment on the number of people that would be hired.

"We have GTECs in China, but this will be first outside china. It is under discussion. Indians have language advantage as well as technology, that is what we want to capitalise on through this centre," Liqun said.

Of the company's $ 1.5 billion Indian revenues, $ 1.2 billion was contributed by its network business driven by 3G deployment and network expansion by operators, while the remaining $ 300 million came from devices like handsets, dongles and set top boxes.

"I think 2012 is a tough year for the whole telecom industry in India because the policy is not clear. Operators are waiting for licences. This period will see no major investment but after all this is solved, we are confident of the Indian market," Liqun said.

The company, which clocked $ 1.5 billion in revenues from India in 2011-12, is also betting big on the roll out of 4G LTE services in India and is targeting more than 50 per cent share of the contracts coming in.

"2011 was a good year for Huawei because our revenue in India increased about 20 per cent... Last year, we began building a new R&D centre in Bangalore, which will house more than 5,000 people. From 2011, the plan is to invest $ two billion in five years in india," Huawei India Chief Executive Officer Cai Liqun said.

This includes the R&D centre, manufacturing and marketing among others, he added.

The company began work on setting up a research and development centre in Bangalore last year, which is expected to house more than 5,000 professionals. It is investing $ 150 million in the facility, which is expected to become operational from June 2013.

Besides, it also has a global service resource centre (GSRC) in Bangalore along with a global network operations centre (GNOC), which is its largest such centre outside of China. These centres cater to its clients across 140 countries.

"We are also planning to set up a global technology centre (GTEC) along with the others (existing centres) in Bangalore maybe this year or the next (year). This Centre will focus on providing technical support to clients globally," Liqun said.

He added that GTEC will handle technical issues of customers globally but declined to comment on the number of people that would be hired.

"We have GTECs in China, but this will be first outside china. It is under discussion. Indians have language advantage as well as technology, that is what we want to capitalise on through this centre," Liqun said.

Of the company's $ 1.5 billion Indian revenues, $ 1.2 billion was contributed by its network business driven by 3G deployment and network expansion by operators, while the remaining $ 300 million came from devices like handsets, dongles and set top boxes.

"I think 2012 is a tough year for the whole telecom industry in India because the policy is not clear. Operators are waiting for licences. This period will see no major investment but after all this is solved, we are confident of the Indian market," Liqun said.

Govt may take back part of spectrum from old operators for refarming

| Press Trust Of India / New Delhi Jun 25, 2012, 00:56 IST |

The telecom ministry is mulling taking back only a part of the spectrum allocated to old telecom players and give chance to other operators to buy that at the auction.

The telecom ministry is mulling taking back only a part of the spectrum allocated to old telecom players and give chance to other operators to buy that at the auction.This proposal is learnt to be part of an amicable solution which the ministry is offering to the industry and is packaged around spectrum price policy, refarming and minimum price of airwaves that is to be paid in the auction due before August 31.

The government has the Telecom Regulatory Authority of India (Trai)’s proposal of refarming under which old operators, such as Bharti Airtel, Vodafone and Idea Cellular, may have to surrender airwaves allocated to them in 900 MHz band (premium frequency band used for 2G services) on expiry of their licences. These companies will have the option to repurchase these airwaves through auction proposed in first half of 2013.

“One of the proposals made is to either refarm all spectrum held by old operators above 5 MHz but then only one new player can enter in the 900 MHz band. The other option is to refarm everything above 2.5 MHz but that will not be liberalised,” a senior government official said.

‘Liberalised Spectrum’, which means allowing companies to provide wireless services using any technology, was one of the key points behind Trai’s recommendation of spectrum price. According to this, a player will have to pay minimum of Rs 3,622 crore for a megahertz of airwaves frequency.

In India, 900 Mhz band and 1,800 MHz band are being used for providing 2G GSM services for mobile telephony, 800 MHz band for 2G CDMA based services, 2,100 MHz band for 3G and 2300 MHz band for 4G level wireless broadband services.

However, it has been identified that telecom players will need a minimum of 5 Mhz spectrum to provide service based on new technology like 3G service in frequency bands being used for 2G services. Under the spectrum pricing policy, sources said, the ministry has proposed to charge for all airwaves currently held by telecom operators (allocated to them at older price for mobile telephony services) at new rates. The new rates will be determined through spectrum auction due before August 31, 2012. “Ministry’s (Telecom) stand is that it wants a level playing field for all operators, new or old from now onwards. At the same time, (it wants to) maintain sanctity of old agreements that is has signed with telecom companies. However, there is no solution that preserves both,” the official said. The official added that though the final decision may not please everyone but government will have to take decision in the interest of nation, industry and consumers.

Regional Manager, Vodafone India Services PvtLtd (Amritsar, Bathinda, Jalandhar, Ludhiana, Mohali, Pathankot, Patiala, Other Punjab)

Job Details

- Area of WorkSales / BD

- IndustryIT - Software

- Location Amritsar, Bathinda, Jalandhar, Ludhiana, Mohali, Pathankot, Patiala, Other Punjab

- Experience8 - 12 Yrs

Job Description

Job Description Distribution management Expands Distribution Network including achieving targeted number of distributors, expanding existing number of Active R/Os, expansion from current status of SIM Outlets and expansion in current status of Activation outlet base. Maintains healthy relations with Premium/ A+ Distributors and key retailers by conducting a minimum one relationship activity per quarter.Ensure Distributor ROI between 30% and 50%. Keeps abreast with VAS / Competition information and ensures POI greater than 95%. Process management Manages Distribution by adhering to norms for recharge/SIM’s/ servicing/ DMS/ FOS/ Claims/ Reports. People development Conducts at least one training program per month for Distt/DSE to enhance their knowledge and skills. Self improvement Takes individual initiatives for improvement in skill sets and value addition HSW To keep yourself abreast with all the Health Safety and Wellbeing policies and procedures(including department specific regulatory requirements) rolled out from time to time, ensure compliance, report any non compliance and actively participate in all HSW related campaigns and activities Desired Profile:8-12 yrs experience.

For more details : http://www.shine.com/jobs/regional-manager/vodafone-india-services-pvtltd/510456/

‘Videocon keen to bid for 2G spectrum’

Mr Arvind Bali, CEO and Director, Videocon.

But awaits clarity on reserve price and quantum of spectrum on sale

New Delhi, June 24:

The Supreme Court’s decision to cancel licences given on or January 10, 2008 has sounded the death knell for most of the 2G players. While players such as Etisalat DB and Stel have shut shop others such as Videocon and Uninor are just about keeping their operations running.

The uncertainty over the auction rules is only adding to their woes. Videocon, which has 7.7 million subscribers across 20 circles, claims to be losing Rs 150 crore a month to keep networks operational.

Business Line spoke to Mr Arvind Bali, CEO, Videocon, on what the company plans to do.

What is your view on the reserve price of Rs 18,000 crore for 5 MHz spectrum proposed by Trai?

The apex court, while cancelling 122 licenses, had directed the Telecom Regulatory Authority of India (Trai) to determine 2G spectrum price through auction process.

Trai, however, on its own added multiple dimensions (without consulting the industry) like making it technology-neutral, putting up only single block of 5 MHz up for auction, etc. in order to justify higher value of spectrum. These recommendations have created artificial scarcity of the spectrum.

To determine the right market value of the spectrum, all the available spectrum should be put for auction at the same time and keep the base price at the last market determined price of 2G spectrum i.e. Rs 1,658 crore. Market forces, in any case, will take the price to its real market value.

What will be Videocon’s strategy during the upcoming auctions? Will you bid in all circles, or will the company bid selectively in just a few circles?

~

Videocon has gone a long way forward and made huge capital investments in mobile service business. We have done 50 per cent roll-out obligation in all the 20 circles where we got spectrum except for Delhi where no spectrum was awarded to any new operator.

We have a strong workforce of around 8,000 direct and indirect employees to back our operations with a customer base of 7.7 million and still growing.

Now, after having invested so much in the business we shall definitely like to stay and make our presence felt in the business. We will be definitely participating in the upcoming auctions.

We would surely bid and try to win back all our circles. But, as on date there is no clarity on the ‘availability of spectrum for auction’ and the ‘reserved base price’. So we are closely watching the developments and will be formulating our strategy for upcoming auction accordingly.

You say you are keen to stay in business but Videocon has not taken any proactive measures like Uninor and Sistema to assure its existing customers that the company is here to stay. In the process you have also lost a significant number of customers post the Apex Court's orders. Why did the company decide to stay low?

The fact that we have been able to retain our customer base proves that we have been very active in the markets where we operate.

We have been regularly sending SMS to all our customers and channel partners on the commitment of the company to actively participate and win back the spectrum. It is a part of our daily ‘Usage and Retention’ activity.

One won’t see our promotional activities in North India as we don’t have spectrum in Delhi and have not done full fledge commercial launch in the Hindi belt of UP, Rajasthan and Bihar.

Our active business circles are scattered across country and we do region-based spending. We also had TV commercials until the time our licenses were quashed.

What is Videocon’s view on the proposal by the government to ask incumbents to pay the auction determined price prospectively remaining period of the licences prospectively?

According to para-81 of the Apex Court’s judgment the licenses granted to the private respondents on or after January 10, 2008 pursuant to two press releases issued on the same day and subsequent allocation of spectrum to the licenses have been declared illegal and subsequently quashed.

If you see the Trai report and compare it with the list of spectrum issued to the private respondent on or after this date, lots of spectrum which presumably be cancelled in line with the judgment has not been taken in the list of available spectrum by Trai/DoT.

For the last 3-4 weeks so many media reporting has happened on the subject, COAI and various aggrieved companies has gone to Govt, lots of NGOs have taken the cause but still there is no visible action.

So if all operators are made to pay the same price prospectively, it will create a level playing field and bring a cordial and more productive environment in the industry.

There is a debate on permitting auction winners to pay the bid amount in instalments. Why should it be allowed?

Companies like Videocon decided to enter the telecom business based on the licences given at 2008 prices. We have been found clear in all the investigations held by the various Government agencies. Now, if the prices of spectrum are going to be increased ten times or more, it is quite logical to provide staggered payment for the operators to survive and business can be continued.

There are talks about changing roll-out obligations for auction winners. Your comment.

When spectrum is bought at market price, the decision of “where and when” to do the roll out should be left to the operator based on their specific business case. The Government can dictate roll out if it is giving any subsidy or concession to the operators.

Finally, there has been a lot of debate on spectrum mortgage. What is Videocon’s position?

Yes, we are in line with the notion that the spectrum should be seen as a tangible asset and all operators holding spectrum should have exclusive rights to mortgage the same.

‘Red zone’ to get 2,198 cell towers

After years of neglect and delays, Naxal-hit areas cut off from all forms of

habitation are set to get full mobile connectivity.

The government has mooted a plan to provide full mobile connectivity to these worst Naxal-hit areas across the country. The Union home ministry has proposed to the information and broadcasting ministry to use the Universal Service Obligation (USO) funds to erect mobile towers in 2,198 locations in nine Naxal-hit states.

Once the Cabinet clears the proposal, BSNL will erect these towers. In the backdrop of the government’s efforts to improve mobile connectivity, the CPI (Maoist) top brass, in a recent directive to its cadres, has asked them to return to the 'courier' service to deliver messages amongst themselves.

The Naxals have been strictly asked not to rely on mobile phones, which they fear are being used by the government to track down their locations and keep an eye on their movements.

The Maoists fear that once mobile connectivity reaches these areas, it will become more and more difficult to control their cadres and stop them from using mobile phones, which may ultimately prove disastrous to their movement, a top security official said.

Presently, only 301 towers have been erected but once the USO funds are used, government officials

are hopeful that mobile connectivity in dense Naxal regions will no longer remain a distant dream.

“It will take some time before we achieve full mobile connectivity in the LWE states, but we have informed state governments of the proposal and the process of identifying these 2198 locations has been completed,” a home ministry official said.

The strategy of police action and development in Naxal areas calls for building infrastructure in remote Naxal areas with the help of security forces. However, government officials posted in these remote corners and even security personnel in police stations face tough challenges for want of better means of communication.

“The well-networked Maoists know the handicap and the mobile towers are their first target,” a security

official said.

The government has mooted a plan to provide full mobile connectivity to these worst Naxal-hit areas across the country. The Union home ministry has proposed to the information and broadcasting ministry to use the Universal Service Obligation (USO) funds to erect mobile towers in 2,198 locations in nine Naxal-hit states.

Once the Cabinet clears the proposal, BSNL will erect these towers. In the backdrop of the government’s efforts to improve mobile connectivity, the CPI (Maoist) top brass, in a recent directive to its cadres, has asked them to return to the 'courier' service to deliver messages amongst themselves.

The Naxals have been strictly asked not to rely on mobile phones, which they fear are being used by the government to track down their locations and keep an eye on their movements.

The Maoists fear that once mobile connectivity reaches these areas, it will become more and more difficult to control their cadres and stop them from using mobile phones, which may ultimately prove disastrous to their movement, a top security official said.

Presently, only 301 towers have been erected but once the USO funds are used, government officials

are hopeful that mobile connectivity in dense Naxal regions will no longer remain a distant dream.

“It will take some time before we achieve full mobile connectivity in the LWE states, but we have informed state governments of the proposal and the process of identifying these 2198 locations has been completed,” a home ministry official said.

The strategy of police action and development in Naxal areas calls for building infrastructure in remote Naxal areas with the help of security forces. However, government officials posted in these remote corners and even security personnel in police stations face tough challenges for want of better means of communication.

“The well-networked Maoists know the handicap and the mobile towers are their first target,” a security

official said.

At Huawei, employees are the only shareholders

Huawei — an easy to miss

name located as a small print behind the USB dongles of Reliance Communications

and Tata DoCoMo — is currently one of the most profit-making telecom equipment

companies in the world and the biggest in China.

With revenues of $32

billion last year and massive investments towards research and development

every year, the 22-year- old giant has never tapped the capital markets in its

history to fund growth.

Nor does it plan to do

so in future.

Huawei has a unique shareholding

pattern – 100% of it is employee-held, and there are no major shareholders.

“Every employee who is a

Chinese national and has spent more than two years in Huawei has claims to some

ownership in the company, through stock holding,” said Scott Sykes, vice

president, corporate media affairs, Huawei.

But they can’t trade the

stock since it’s not listed.

Huawei introduced the employee stock option programme across its Chinese operations in 1990 out of a need to bring in more responsibility and a sense of ownership among staff, just when the company was starting to dream global.

Huawei introduced the employee stock option programme across its Chinese operations in 1990 out of a need to bring in more responsibility and a sense of ownership among staff, just when the company was starting to dream global.

With 140,000 employees

now and a presence in 140 countries, almost 60,000 are part-owners.

With those joining

Huawei every year more than those leaving, each year, a new set of shares are

issued. Or shares from staff leaving are reissued. The quantity depends on

skills and experience.

Sykes said the company

is toying with the idea of opening up the scheme to non-Chinese nationals too,

including himself.

A non-Chinese, he joined Huawei’s Shenzhen headquarters last year after a few years at Alcatel Lucent.

A non-Chinese, he joined Huawei’s Shenzhen headquarters last year after a few years at Alcatel Lucent.

Interestingly, the

founder of the company — Ren Zhengfei — is its biggest shareholder, but he owns

just 1.4% shares.

“Our founder has always

been of the opinion that all employees should act as owners and hence we all

are shareholders. If the company makes good profit, we get higher dividends and

if it doesn’t, our dividend payout is less,” said Rajiv Weimin Yao, vice

president, corporate affairs, Huawei India.

Yao works in Huawei’s

Gurgaon centre in India. As a Chinese national, he enjoys the benefits.

When an employee leaves,

he has to sell his shares back to the company unless the person is too senior,

having spent 10-15 years working for it.

“In such cases, the

person is allowed to retain his shares which he can trade with the company at a

later date,” said Suresh Vaidyanathan, head, brand and PR, India Marketing,

Huawei India.

Staffers can’t sell the shares to each other either. While the system comes with its advantages, it has drawbacks too.

Staffers can’t sell the shares to each other either. While the system comes with its advantages, it has drawbacks too.

“Because of this complex

structure of shareholding, it is very difficult for the company to get listed

and raise money from the markets as this will require a lot of exercise in

terms of restructuring the shareholding pattern,” said Sykes.

With targeted revenues of

$100 billion by 2020 and a growth rate of over 20% annually, it certainly

presents a juicy lolly for investment bankers.Govt approves Trai proposal of refarming, eyes spectrum of Bharti Airtel, Vodafone

|

|

Bharti Airtel may have to surrender airwaves allocated to it in 900 Mhz band on expiry of its licence

The government has approved the Telecom Regulatory Authority of India's (Trai) proposal of refarming, under which old operators namely Bharti Airtel, Vodafone and Idea Cellular, may have to surrender airwaves allocated to them in 900 Mhz band (premium frequency band used for 2G services) on expiry of their licences.

These companies will have the option to repurchase these airwaves through auction proposed in first half of 2013.

The proposal is learnt to be part of an amicable solution, which the telecom ministry is offering to the industry, and is packaged around spectrum price policy, refarming and minimum price of airwaves to be paid in the auction, due before August 31.

Meanwhile, in a move to bring uniformity in the sector, the government has decided to charge 8 per cent of gross revenue as licence fee from all telecom firms across all categories and services from 2013-14.

BSNL set to launch IPTV service in Goa

BSNL is all set to launch an internet protocol television (IPTV), with high speed broadband connection, delivered over optical fibre service in Goa.

According to a report in The Times of India (TOI), Sujeet Kumar, BSNL's Deputy General Manager, said that the IPTV network is ready and the company can feed the service. The company is currently looking for a franchisee to operate the new service.

The telecommunications operator will provide live television and video on demand at a monthly subscription fee between Rs. 100 and Rs. 300.

BSNL has already launched its IPTV service in Pune, Kolhapur, Nagpur, Jaipur, Bangalore and other cities.

The company is currently in talks with building contractors in Dona Paula, Panaji and Socorro for the installation of fibre optic cable in structures under construction.

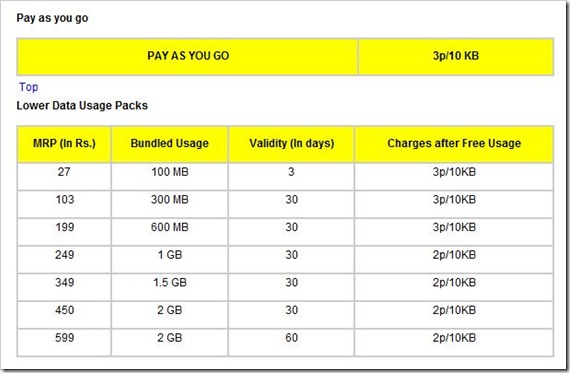

3G Data Rate Comparison: Airtel vs Vodafone vs Idea vs Reliance

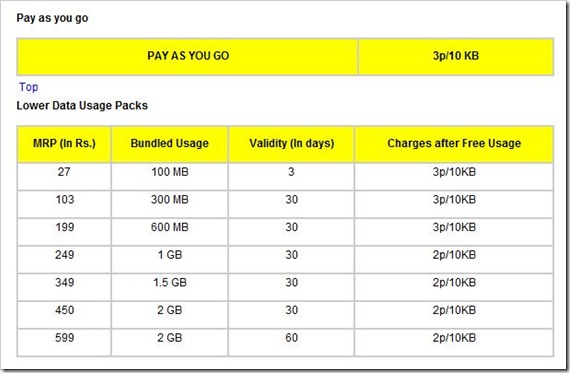

In the last few months, mobile service providers in India have been aggressively slashing their 3G rates to get India Inc. craving for 3G speeds. Bharti Airtel began the price war by slashing its 3G rates by 70%. Reliance was soon to follow with a reduction of up to 90%. Vodafone later announced a decrease of up to 80% in its own 3G rates and so did Idea Cellular.

Indian youth mobile users are known to opt for prepaid over postpaid. Last year, a Nielson survey pointed out that 97% of them used prepaid mobile connections. In this post also, we take a look at usage based prepaid 3G tariffs of some of India’s leading mobile service providers.

Please note that the below comparison is based on 3G rates of Airtel, Vodafone, Idea and Reliance for the Mumbai circle; and have been sourced from their respective websites.

Idea Cellular’s Prepaid Usage based 3G plans start from Rs. 103 for 300 MB and go up to Rs. 2,500 for 10 GB. All these plans come with a validity period varying from 30, 60 to 90 days and usage over and above the allotted data limit is charged at 2ps per 10 KB which is approximately Rs. 2 per MB.

The highlight of Idea’s 3G tariff plan is the Rs. 950 recharge. Valid for 30 days, it offers 3G access up to 6 GB following which unlimited usage is restricted to 128 kbps.

See the entire Idea 3G prepaid Rates

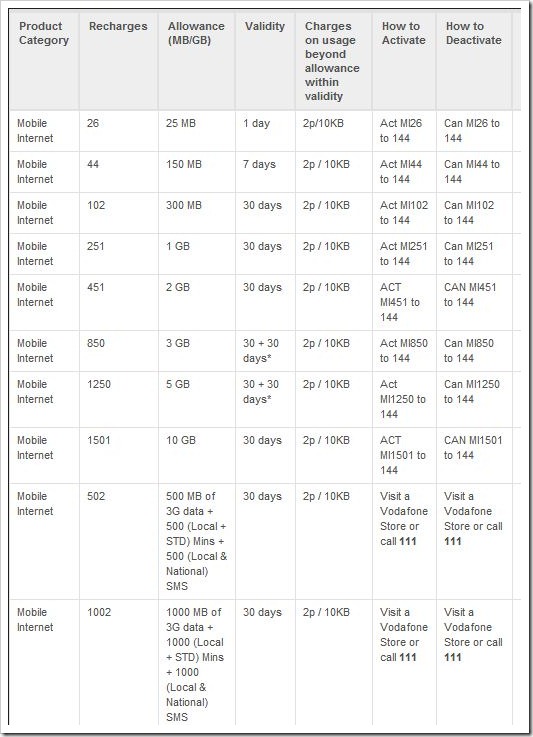

Vodafone’s prepaid 3G plans seem to be very competitively priced and with a tiny recharge of Rs. 26 for 25 MB valid for 24 hours, there is little more that budget ZooZoo users could ask for. 30 day validity plans begin with Rs. 102 for 300 MB and go up to Rs. 1,250 for 5 GB and Rs. 1,501 for 10 GB. Additionally, Vodafone also offers its customers options of recharging for Rs. 502 and Rs. 1002 which come with additional 500/1000 local and STD minutes along with 500/1000 free local and national SMS.

Almost all the plans carry a charge of Rs. 2p per 10 KB once usage limit has been exceeded.

See the entire Vodafone 3G prepaid Rates

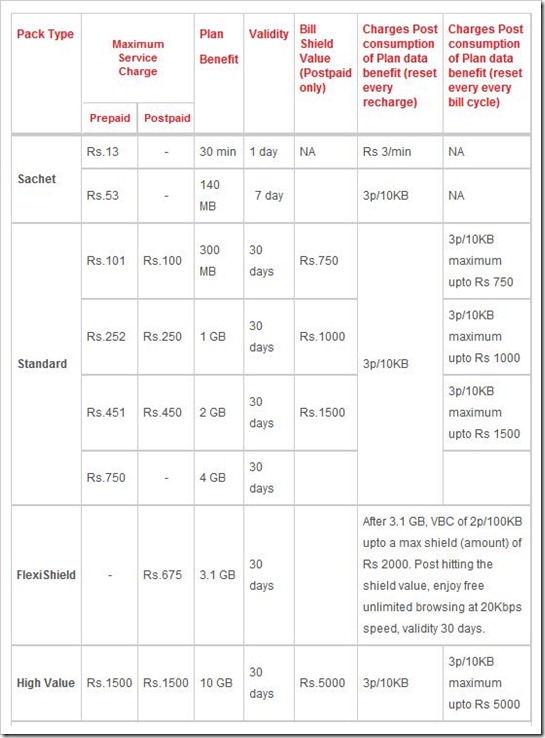

Airtel has a variety of flexible 3G plans including a tariff termed as the ‘Sachet’ plan type under which 30 mins of 3G accessibility can be availed for Rs. 13. Under the same type, a very exciting budget prepaid tariff option is Rs. 41 for 150 MB which is valid for 7 days.

Airtel’s ‘Standard’ prepaid 3G plans vary from Rs. 101 for 300 MB to Rs. 750 for 4 GB and the ‘High Value’ plans offer 10 GB for Rs. 1,500. Most plans have a validity period of 30 days however unlike Vodafone and Idea Cellular, Airtel’s prepaid packs carry a 3p per 10 KB charge on excess usage instead of 2p.

See Airtel’s full 3G rate Card

Similar to Airtel’s Sachet plan, Reliance 3G tariffs also offer a low value day pack of Rs. 10 for Rs. 30 MB, valid for 24 hours. Starting from Rs. 97 for 300 MB to Rs. 448 for 2 GB, Reliance’s 3G plans which carry a validity of 30 days are aggressively priced but lack high value options beyond 2 GB. Like Airtel, excess usage beyond allocated data limit is charged at 3p per 10 KB.

View Full Reliance 3G Rate Card

Indian youth mobile users are known to opt for prepaid over postpaid. Last year, a Nielson survey pointed out that 97% of them used prepaid mobile connections. In this post also, we take a look at usage based prepaid 3G tariffs of some of India’s leading mobile service providers.

Please note that the below comparison is based on 3G rates of Airtel, Vodafone, Idea and Reliance for the Mumbai circle; and have been sourced from their respective websites.

Idea Cellular 3G pricing

Idea Cellular’s Prepaid Usage based 3G plans start from Rs. 103 for 300 MB and go up to Rs. 2,500 for 10 GB. All these plans come with a validity period varying from 30, 60 to 90 days and usage over and above the allotted data limit is charged at 2ps per 10 KB which is approximately Rs. 2 per MB.

The highlight of Idea’s 3G tariff plan is the Rs. 950 recharge. Valid for 30 days, it offers 3G access up to 6 GB following which unlimited usage is restricted to 128 kbps.

See the entire Idea 3G prepaid Rates

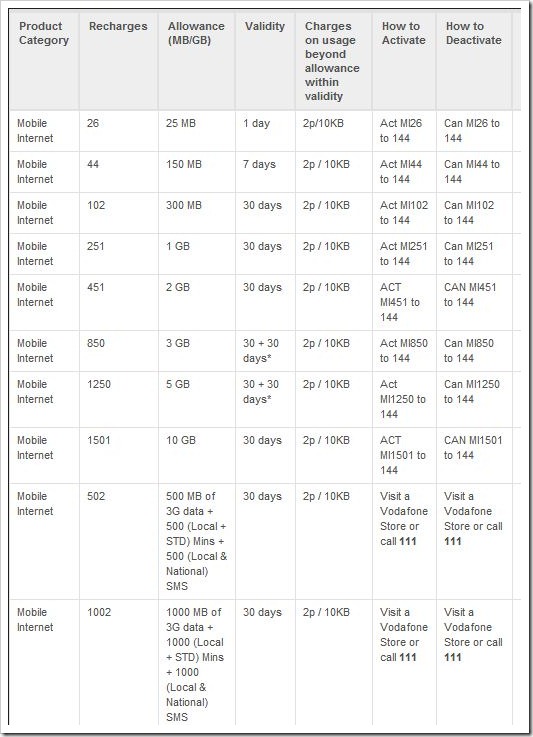

Vodafone 3G pricing

Vodafone’s prepaid 3G plans seem to be very competitively priced and with a tiny recharge of Rs. 26 for 25 MB valid for 24 hours, there is little more that budget ZooZoo users could ask for. 30 day validity plans begin with Rs. 102 for 300 MB and go up to Rs. 1,250 for 5 GB and Rs. 1,501 for 10 GB. Additionally, Vodafone also offers its customers options of recharging for Rs. 502 and Rs. 1002 which come with additional 500/1000 local and STD minutes along with 500/1000 free local and national SMS.

Almost all the plans carry a charge of Rs. 2p per 10 KB once usage limit has been exceeded.

See the entire Vodafone 3G prepaid Rates

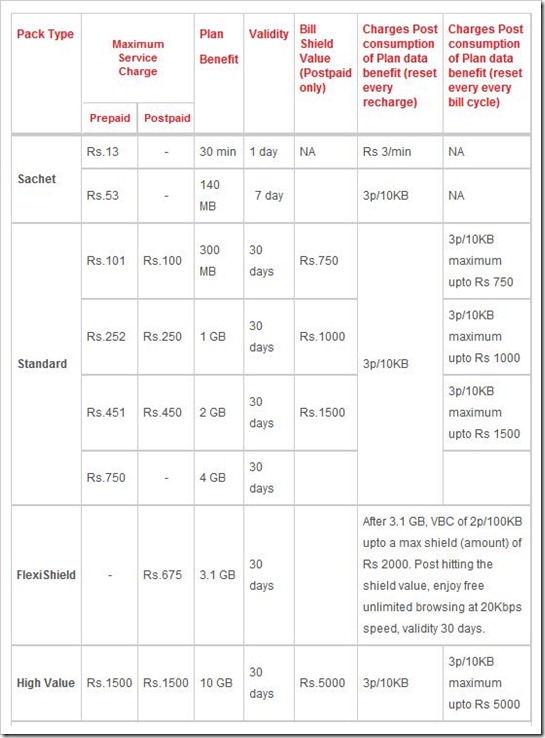

Airtel 3G pricing

Airtel has a variety of flexible 3G plans including a tariff termed as the ‘Sachet’ plan type under which 30 mins of 3G accessibility can be availed for Rs. 13. Under the same type, a very exciting budget prepaid tariff option is Rs. 41 for 150 MB which is valid for 7 days.

Airtel’s ‘Standard’ prepaid 3G plans vary from Rs. 101 for 300 MB to Rs. 750 for 4 GB and the ‘High Value’ plans offer 10 GB for Rs. 1,500. Most plans have a validity period of 30 days however unlike Vodafone and Idea Cellular, Airtel’s prepaid packs carry a 3p per 10 KB charge on excess usage instead of 2p.

See Airtel’s full 3G rate Card

Reliance 3G pricing

Similar to Airtel’s Sachet plan, Reliance 3G tariffs also offer a low value day pack of Rs. 10 for Rs. 30 MB, valid for 24 hours. Starting from Rs. 97 for 300 MB to Rs. 448 for 2 GB, Reliance’s 3G plans which carry a validity of 30 days are aggressively priced but lack high value options beyond 2 GB. Like Airtel, excess usage beyond allocated data limit is charged at 3p per 10 KB.

View Full Reliance 3G Rate Card

Key highlights

- Idea’s Unlimited plan is a value packed option as it offers 3G speeds up to 6 GB followed by an unlimited access at 129 kbps for Rs. 950 for a 30 day period. There is no charge per KB up to the expiry of the 30 day period. This plan is a top pick for users with high usage who wouldn’t mind slower speeds after 6 GB usage.

- Airtel and Reliance prepaid 3G plans carry a charge of 3p per 10 KB on excess usage as compared to 2p levied by Vodafone and Idea Cellular, about 50% more.

- Airtel and Reliance 3G users can avail prepaid access to super budget low value plans of Rs. 13 and Rs. 10 respectively. On these plans, Airtel offers 30 mins of 3G access while Reliance offers 30 MB. Both these are top picks for users who want a one-off 3G access for a day.

- Prepaid tariff plans for Reliance 3G suggest that there is lack of flexibility for high end prepaid users who are likely to go beyond 2GB per month.

- Idea offers maximum flexibility in terms of validity period. Two of its usage based plans offer 60 day validity as opposed to the normal 30 day period.

Sunday 24 June 2012

Aircel FRC56, All Local 1p/2Sec for 180 Days

Aircel has come up with a new FRC (First Recharge Voucher) of Rs. 56 for the prepaid customer of West Bengal (RoB) telecom circle which is one of the cheapest for both local off-net and on-net calling with a long term validity.

The cost of the voucher is Rs. 56 which will give 180 days validity. Local on-net call rate is 1p/3Sec whereas local off-net 1p/2sec.

The local on-net effective call rate is 20p/min, one of the best features of this plan. Along with Bangladesh calling is 5p/Sec. NLD/STD is 1p/Sec flat.

The pack is bundled with 100 MB 2G Data for initial 15 Days. After the fist charged SMS 50 Local/national SMS will be provided free of cost for 30 days.

Aircel FRC56 Plan Details

MRP

|

TYPE OF THE VOUCHER

|

BENEFITS

|

VALIDITY

|

| Rs. 56 |

First Recharge Voucher

|

| 180 Days |

For more details call Aircel CC at 121 or 98510-12345

Note: This plan is currently available only in WB circle, and only valid for new customer this offer is cheaper than Reliance GSM FRC28 plan which is currently providing same call rate except lower on-net call rate and bundled freebies with a validity of 90 days. MTS , which is known for its cheapest voice tariff is providing costlier tariff of Rs. 48 pan for 90 Days for 1p/2Sec Local calling.

Subscribe to:

Posts (Atom)